Want to know how to choose the right currency pair to trade? Realise first of all that currency pairs are different so there is no one-size-fits-all strategy. Sort them according to their level of volatility, their trading pattern and their performance then pick one according to your strategy and fits your psychology.

If you are able to pick winning currency pairs but often end up with slower moving ones, this blog post could help you improve your trading performance. If you have a consistent winning record with some forex pairs but fail to make headway with others, read on.

Currency pairs behave differently

Different performance over time

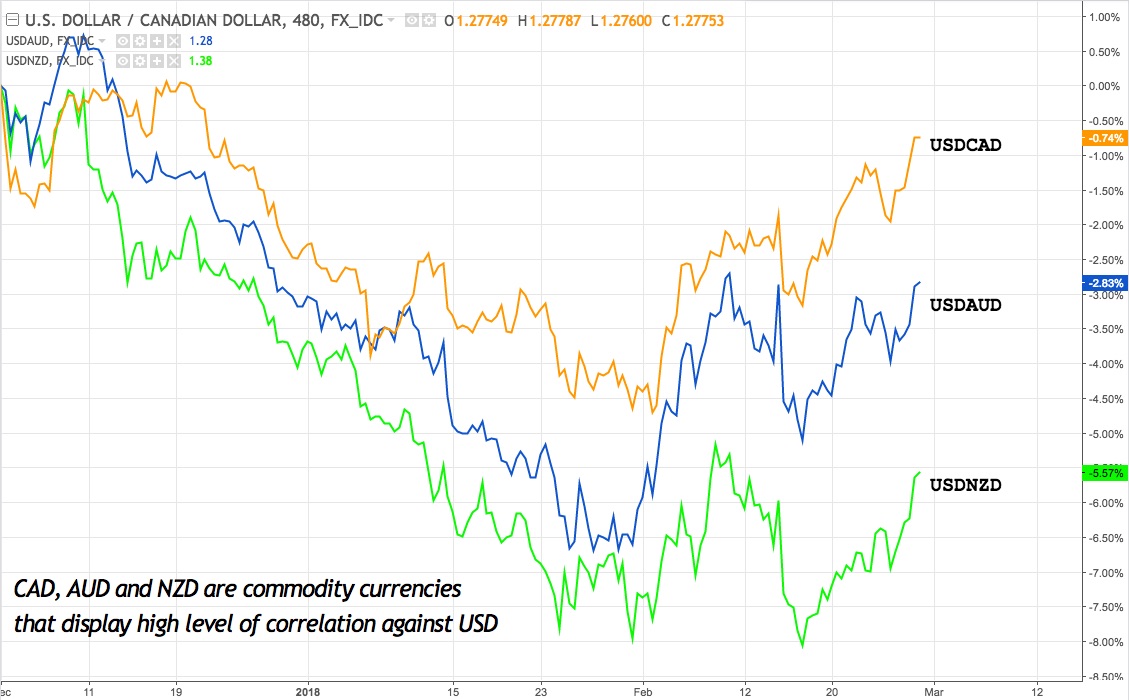

Many currency pairs appear to move together in the same direction i.e. display high level of positive correlation. Closer scrutiny however reveals that over a period of time, they deliver different levels of performance. So a forex trader might be able to ride a winning trend but end up holding a slow performer.

Tip: When you have a group of currency pairs moving in the same direction, picking the strongest pair can deliver you outperformance.

Different volatility over time

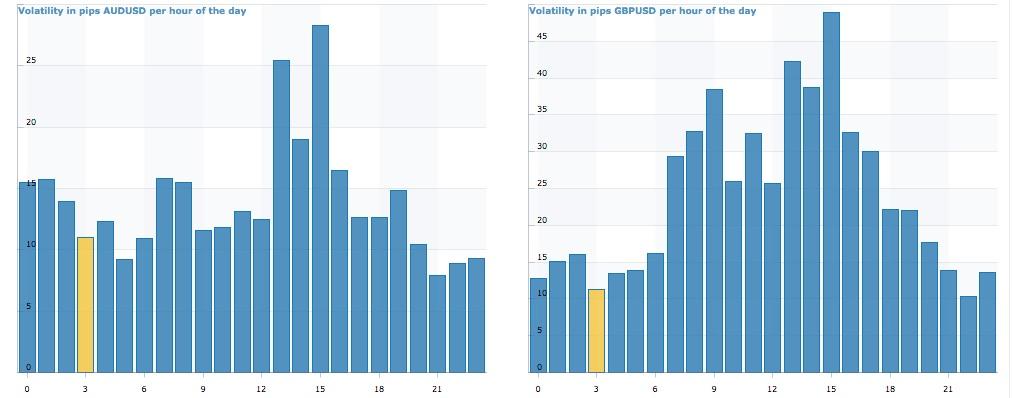

A comparison of AUDUSD and GBPUSD performance over different time durations also shows that they are very different.

These two tables show volatility in pips moved per hour of day between AUDUSD (left) and GBPUSD. This volatility is based on the average movement at each hour tracked over 10 weeks. Look at number vertical axis on left side of each table. Very prominently, GBPUSD has a higher movement in number of pips moved.

Tip: Choose a currency pair that is active in your timezone especially if you are a day trader.

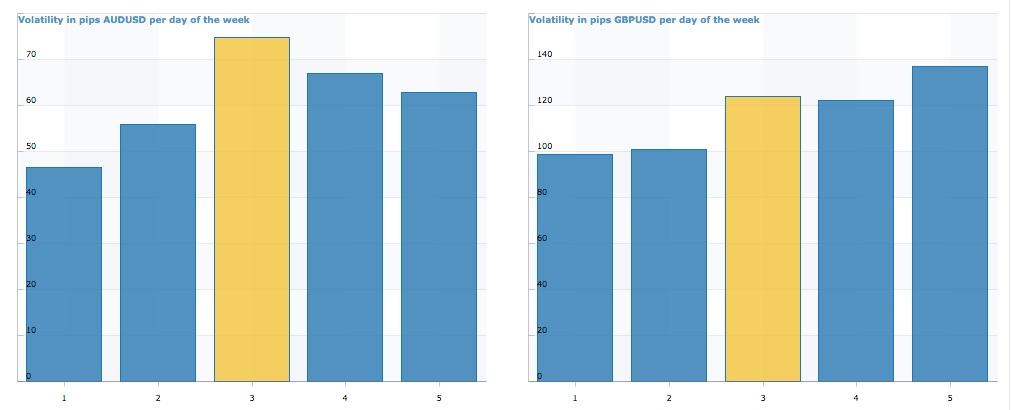

These two tables below show volatility in pips moved per day of the week between AUDUSD (left) and GBPUSD. The numbers here represent average over 10 weeks. Look at number vertical axis on left side of each table. GBPUSD not only has a higher full day movement than AUDUSD, both currency pairs show clearly different performance day to day.

Tip: If you do not have the luxury to trade full time, plan your trades around your other activities.

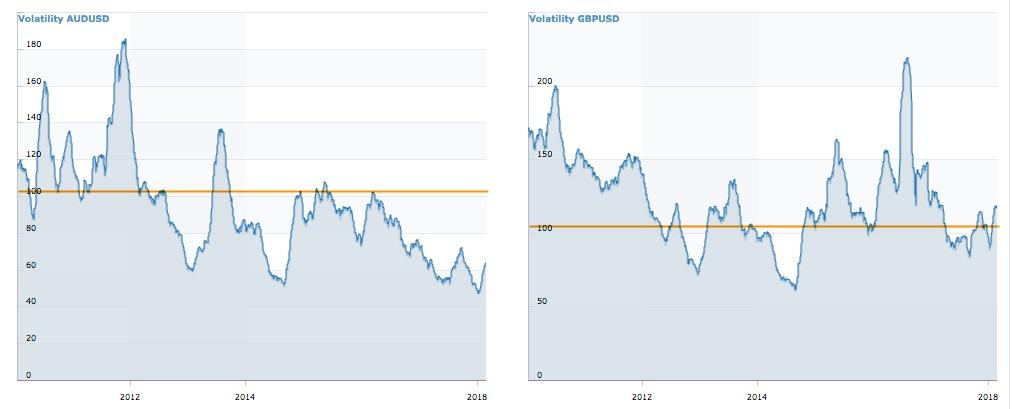

These two charts show AUDUSD and GBPUSD weekly high – low average from 2010 to present. The clear takeaway from these tables show that GBPUSD’s weekly volatility tends to be over 100 pips and at the extreme end exceeds 200 pips. Compared to GBPUSD, AUDUSD has tighter movement.

Tip: Currency pairs are different. Some are stable and some are wild. Pick one that fits you.

Some pairs are just not meant for trading

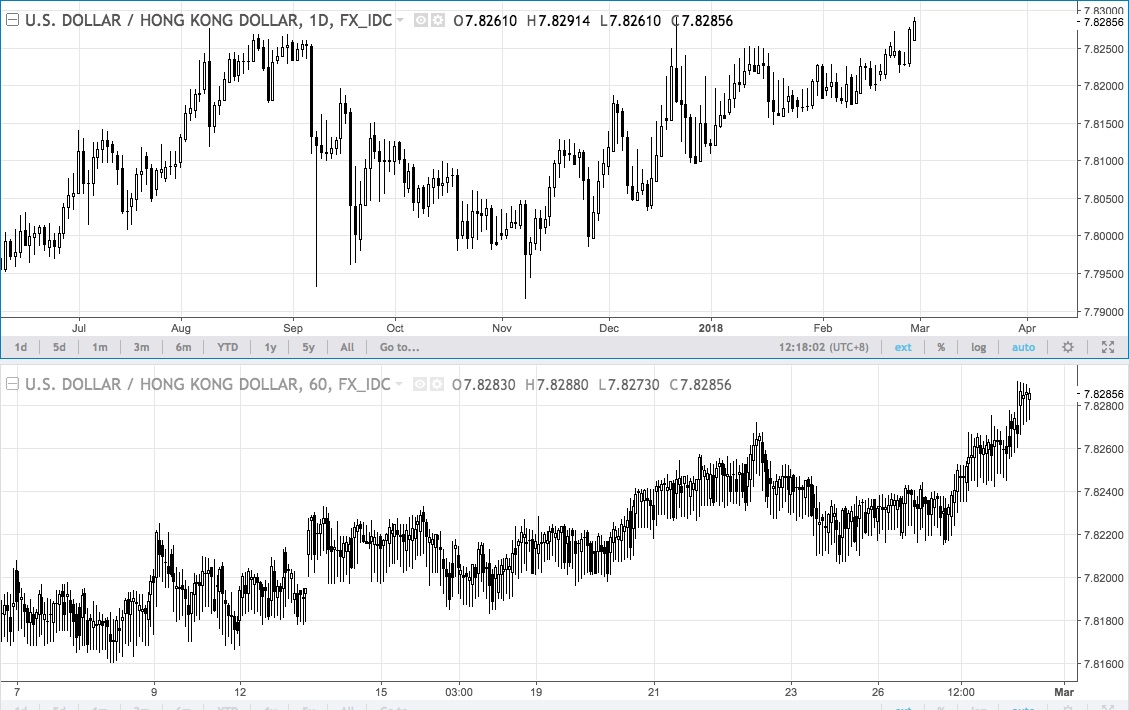

These two tables show daily price action (top) and 60-minute price action of USDHKD. Hong Kong Monetary Authority pegged the Hong Kong Dollar to the USD in a Linked Exchange Rate System or LERS so USDHKD is trapped within a managed range. There is very little directional movement; intraday and even day to day candles are most inside bars so there is virtual no room for short term trading.

Tip: Visual inspection can tell you if a currency pair is suitable for trading. Some have very little movement. Some are full of false signals.

Additional tips for currency traders ‘How to pick the right pair to trade’

- Currency pairs may go through different episodes where they fluctuate wildly. These are driven by special events or policies. It could be a ‘one-time deal’ like Brexit or it could be cyclical like parliamentary elections. Some are fleeting while others persist for a while. Keep yourself update with these development.

- Choose a forex pair that fits your psychology. If you are risk averse, a pair with tighter movement hour to hour or day to day will make you feel more at ease than a pair like GBPUSD that has wider movement. Being at ease means that you are less challenged to make mistakes. If you are not averse to risk, high volatility pairs like GBPUSD could be just for you. There are other pairs such as GBPCHF and GNPJPY that have even higher volatility.

- Since each currency pair is different, there is no one-size-fits-all trading strategy. If you have a strategy that uses a fixed 50 pips stop loss for example, it is clear that 50 pips stop loss might be adequate for a tight moving pair but inadequate for a currency pair that has wider volatility. Choose a currency pair that fits your strategy – high volatility, high potential for gain, high potential for loss, requires higher tolerance or lower volatility, lesser potential for gain, less potential loss, lower tolerance and more at ease.

- Traders should have a clear plan and choose the right pair to execute the plan. If you are a day trader and use a trend following strategy, choosing a pair that has a lot of intra-day movement may be the right thing to do. Choosing a pair that is inactive could just make you tear your hair out.

- Keep track of relative performance between currency pairs. If you find pairs that have very high correlation, put them into a group and track their relative performance. Make use of performance tools to separate them by performance. Being able to go long the strongest or short the weakest all the time will deliver you outperformance. This topic is covered here in more detail.